How magnets and batteries are key to critical material recovery growth

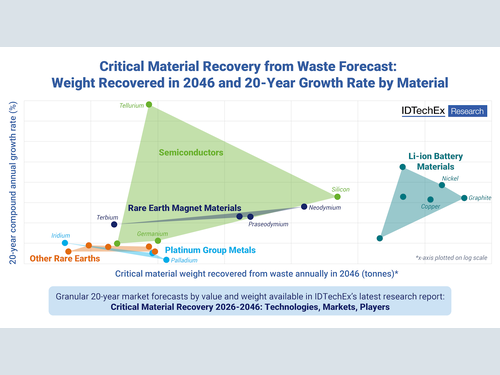

Critical material recycling enables the recovery of economically valuable rare earths, semiconductors, platinum group metals, and battery materials from waste while mitigating associated supply risks. Secondary sources, such as waste, are quickly becoming attractive alternatives to primary minerals. Secondary sources are typically available at the point of consumption, require substantially lower capital investment to develop, and are circular and sustainable. IDTechEx forecasts that over 8,150 ktonnes of critical materials will be recovered from waste annually by 2046.

IDTechEx's latest research identifies critical rare earth recovery and lithium-ion battery recycling as key growth markets, driven by ease of recovery, growing waste volume, and increasing regulatory and policy pressures mandating recycling.

Rare earth magnet recycling to become key secondary source of critical rare earths

With rare earth permanent magnet demand to grow 69% and surpass 332,000 tonnes per annum by 2036, recycled magnets are set to become key sources of valuable critical rare earths. Neodymium magnets can contain up to 32% by weight of valuable neodymium, praseodymium, dysprosium, and terbium metals, significantly higher than in primary mineral sources, where high grade deposits typically contain ~12% by weight of total rare earths.

As rare earth demand and value consolidate in magnet applications, differing recycling technology approaches are emerging to enable recovery from waste. Long-loop magnet recycling using scalable hydrometallurgical processing, solvent extraction, and liquid chromatography affords separated rare earth salts for resale into diverse application verticals. Long-loop recycling is the leading recovery technology in 2025, as companies including Solvay, MP Materials, Carester, and Ionic Technologies position to process both primary minerals and secondary sources until waste feedstock volumes grow.

Emerging short-loop recycling technology uses powder metallurgical processing, such as hydrogen decrepitation, to recycle NdFeB magnets as demagnetized powders for remanufacturing. Short-loop recyclers typically recycle and manufacture new magnet products using up to 97% recycled rare earth content. Short-loop rare earth magnet recycling has lower OPEX costs and is less carbon intensive than long-loop recycling, and by manufacturing new magnets with recycled feedstock, more value can be captured by processors.

The production and sale of rare earth magnets remain key to the economics of short-loop recycling in the short- to medium-term. In 2025, market-leading short-loop recycler Noveon Magnetics announced supply agreements with both General Motors and ABB to provide high performance magnets for automotive and industrial motor applications.

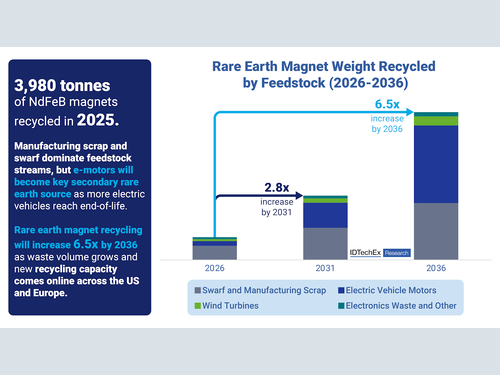

IDTechEx estimates that 3,980 tonnes of neodymium magnets will be recycled in 2025, with magnet swarf and manufacturing scrap set to dominate recycling feedstocks in the short term. IDTechEx predicts that rare earth magnet recycling by weight will grow 2.8x by 2031 and 6.5x by 2036, as recycling capacity grows and waste streams develop.

Manufacturing scrap will be a dominant secondary rare earth source and become increasingly available as magnet production capacity across Europe and North America triples by 2030. As significant volumes of electric vehicles approach end-of-life, electric motors used in drivetrains and other vehicle components will emerge as important secondary rare earth sources by the mid-2030's.

Demand, regulations, and waste volume growth driving critical battery material recycling

Annual critical battery material demand is expected to triple by 2035 as lithium-ion batteries remain the leading technology enabling electrification within consumer electronics, electric vehicles, and energy storage systems. As demand grow, Li-ion battery (LIB) recycling is becoming increasingly important to recover critical materials used in cathodes, anodes, and current collectors.

Pyrometallurgical and hydrometallurgical technologies are commercially available for recycling nickel, cobalt, lithium, and manganese from cathode materials and copper from current collectors. Emerging direct Li-ion battery recycling technologies may offer a cheaper alternative for regenerating cathode materials, particularly for LFP chemistries, but remain at a much earlier stage of development (TRL 4-6).

The increasing popularity of LFP cathode chemistries and ongoing reliance on China for battery graphite supplies is creating a market pull for greater graphite recycling from batteries. While commercial graphite recycling from Li-ion batteries is limited in 2025 due to the low value recoverable and purity challenges facing recycled materials, continued growth in graphite anode demand will stimulate greater recycling over the next two decades.

Increasing battery material demand does, however, represent a double-edged sword for recycling. Growing global battery material oversupply since 2022 has depressed metal prices, impacting the economics of lithium-ion battery recycling. In 2024, annual lithium production was 190% greater than in 2020, while cobalt and graphite production were 104% and 66% greater, respectively. Battery material oversupply has placed downwards pressure on commodity prices, squeezing the value recoverable from Li-ion battery recycling, and profit margins for recyclers.

Nevertheless, growing recycling regulations and policies will increasingly mandate LIB recycling, with China, the EU, and India leading global battery recycling regulation in 2025. China has various regulations in place includingextensive end-of-life policies and traceability platforms. Meanwhile, the EU Battery Regulation sets out increasing targets for collection rates, recycling efficiencies, and minimum recycled contents in new industrial and EV batteries. IDTechEx forecasts that the Li-ion battery recycling market will to grow to US$52B in value by 2045, as regulations, demand, and waste volume grow over the coming decade.

Critical material recovery market outlook

IDTechEx forecasts that the global critical material recovery market will grow at 9.2% CAGR to exceed US$66 billion per year by 2046. Critical battery material recycling and rare earth recovery represent the highest growth opportunities, as significant volumes of critical material-containing end-of-life electric vehicles enter the waste stream over the coming decade. Emerging global regulations and incentives will be a key market driver, increasingly placing responsibility on manufacturers to ensure critical materials are recoverable and recycled from waste.

Full technology evaluation, market analysis, key players, and granular 20-year critical material recovery market forecasts can be found at 'Critical Material Recovery 2026-2046: Technologies, Markets, Players'.