Four years of decline in British construction demand threatens jobs and future capacity, warns MPA

• New economic data show construction demand for essential mineral products fell to new lows in 2025

• Planning delays and weak housing demand are choking the market, with London a stand-out weak spot

• Investment in British industry is hit hard, leading to site closures and lost jobs

New data from the Mineral Products Association (MPA) show that demand for core construction materials remains stuck at alarmingly weak levels, placing businesses under severe strain and threatening jobs now and supply capacity for the future.

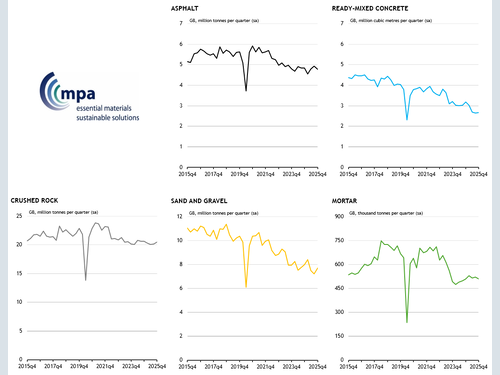

While sales of some products stabilised at a low base in the fourth quarter of 2025, there was no change in the overall picture. Over 2025 as a whole, demand for key materials including concrete (-9.9%), aggregates (-1.6%) and asphalt (-1.1%) fell for a fourth consecutive year, leaving sales volumes at historic lows. A 5.2% annual increase in mortar sales masked a sharp loss of momentum in the second half of the year.

Weak materials demand, alongside rising costs, is forcing businesses to take difficult decisions to cut capacity and control costs, according to MPA. Sites are being mothballed, investment deferred and skilled jobs put at risk. These pressures threaten the longer-term resilience of domestic supply chains for essential mineral products, many of which cannot be realistically imported, potentially undermining the delivery of future housing and infrastructure.

Aurelie Delannoy, Director of Economic Affairs at the MPA, said: “The prolonged downturn in demand for mineral products showed no sign of easing at the end of 2025. This reflects the fragile state of both the UK construction sector and the wider economy, as well as persistently weak investment confidence. These materials are used at the very start of construction projects, and sustained weakness in demand shows Britain is not meeting its commitments to build more homes or speed up the delivery of critical infrastructure.”

MPA argues that the four-year downturn in materials demand reflects a chronic lack of new work across housing, commercial development and infrastructure.

London falling

The London market bore the brunt of this downturn, particularly for ready-mixed concrete, where annual sales volumes fell by a record 27% in 2025 and stood some 39% below 2023 levels. Economic uncertainty, affordability constraints and construction project viability challenges have severely curtailed new build activity in both the residential and commercial sectors, compounded by planning delays to high-rise developments linked to backlogs at the Building Safety Regulator. The scale of the fall in concrete demand suggests housing delivery is falling well short of stated ambitions.

“The Government also risks making things worse in the near term,” Delannoy added. “The slow pace of decision-making on pre-announced emergency measures to support housebuilding in London, including changes to affordable housing thresholds and temporary relief from the Community Infrastructure Levy, risks delaying activity further, as shovel-ready projects are paused until the support is in place. It also creates an incentive to revisit existing planning applications to meet relaxed affordable housing criteria, causing additional delays.”

Housing constrained

Housebuilding, which accounts for almost 25% of construction aggregates demand and around 30% of ready-mixed concrete demand, has yet to show signs of a sustained recovery. Despite mortgage rates falling to a three-year low, affordability remains the dominant constraint on demand. Rising unemployment is at risk of undermining household confidence further. Mortar sales, which closely track housebuilding activity, rose by 5.2% in 2025 but momentum faded in the second half of the year, culminating in a 2% fall in volumes in the final quarter.

Road to nowhere

Infrastructure activity has provided only partial support. HS2 continues to contribute to demand, but volumes of aggregates and concrete tapered off during 2025, partly reflecting the programme reset. Early construction at Sizewell C is expected to underpin demand for aggregates this year, but there are few other major projects ready to offset weakness elsewhere. A particular weak spot is roads, where asphalt demand remains at low levels not seen since 2013 amid persistent project delays, the cancellation of ten major schemes by the current administration, and tight local authority budgets constraining maintenance works.

Chris Leese, Executive Chair of the MPA, said: “Construction materials are one of the clearest early indicators of activity on the ground. Despite the scale of the political ambition, the Autumn Budget fell short on growth, and without swift, decisive action to restore confidence and unlock investment, the UK risks undermining its ability to deliver the housing and infrastructure it needs. When material demand remains this weak for this long, it points to serious delivery failures and growing risks to the UK’s domestic supply capacity.”

Looking ahead, even more increases in business costs this year, including from higher business rates and the fuel duty increase from September, alongside lacklustre UK economic growth and subdued investor confidence, are expected to weigh heavily on near-term market prospects. Any meaningful improvement in demand for mineral products will depend on a recovery in house buyer demand and business confidence sufficient to unlock delayed investment over the next few months. Even then, a sustained recovery in materials demand is unlikely to take hold before 2027.